Reit monthly dividend calculator

Investing in ElevateMoney REIT Is common shares is speculative and involves substantial risks. Four REITs paying monthly dividends.

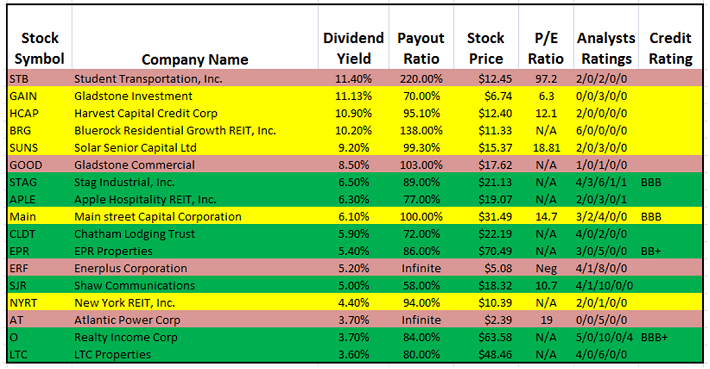

The Complete List Of Monthly Dividend Stocks Paying 4 Plus Dividendinvestor Com

ARMOUR has elected to be taxed as a real estate investment trust REIT for US.

. Federal income tax purposes. O is a monthly-paying dividend REIT that owns and has long-term triple net lease agreements with more than 11400 properties. Of the 7500 plus stocks on the US exchanges 15 real-estate investment trusts pay a monthly dividend.

Dividends paid in excess of current tax earnings and profits for the year will. Ad DividendInvestor is an AwardWinning Dividend Screening Platform. This REIT converted to a monthly payout schedule in 2021 but its been public since 1994.

Realty Income Corp ticker O with a current annualized dividend of 404. The formula for calculating dividend yield is. For example a company with a share price of 100 that pays a 5 dividend per share has a dividend yield of 5.

Ad Search For Results with us Now. Dividend Reinvestment Calculator As of 09082022. The Risk Factors section of the.

Reit monthly dividend calculator. The Pros Cons of Monthly Dividend REITS. We have top picks to help you weather the storm.

The benefit of real estate investing is the potential to earn passive income in the form of monthly dividends and automatically reinvest those dividends to compound your returns. Some pay dividends monthly. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts.

SL Green Realty Corp ticker. Federal income tax purposes. Have you ever wondered how much money you could.

Please note that the listed annual payout and dividend yield is based on the previous 12 months of dividend payments. Search For the Latest Results at findresultsnowco. SLG with a current annualized dividend of 788.

Reit monthly dividend calculator. This article details the companies their market capitalization and their current dividend yield in 2021. Annual dividend per shareprice per share.

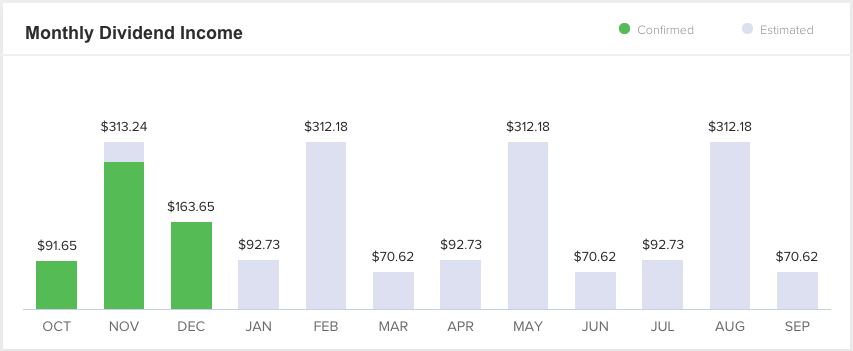

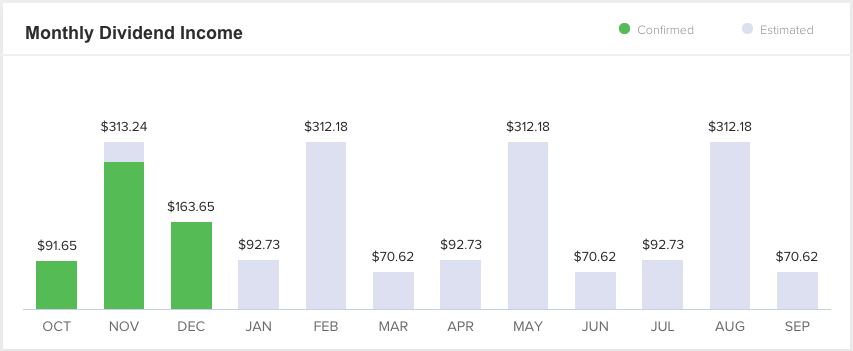

Have you ever wondered how much money you could make by investing a small sum in dividend-paying stocks. Monthly REIT Dividend Stocks Summary. High Dividend REITs.

Realty Income Corp. The number of monthly dividend-paying stocks is relatively limited and if you truly want a monthly dividend stream youd have to buy many of them or you. Whitestone Dividend Yield 41.

O is a monthly-paying dividend REIT that owns and has long-term triple net lease agreements with more than 11400 properties throughout the world. A REIT may deduct the dividends paid to its shareholders from. Check out closed-end funds for monthly dividends.

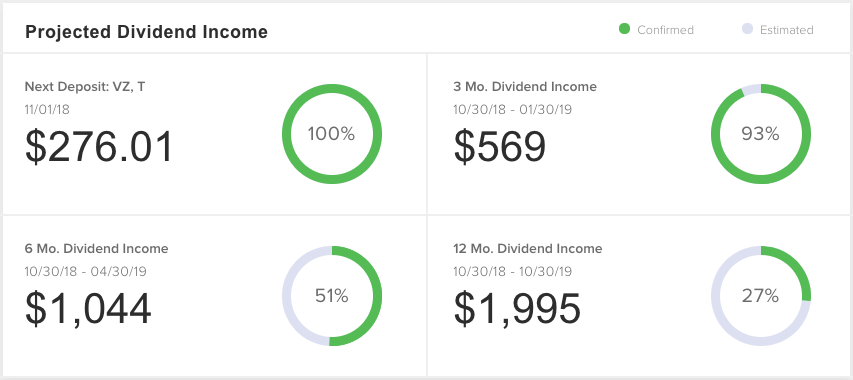

You can screen stocks based on industry size yield payout ratio and dividend history. Tenant list includes. Investment Date Original Shares Original Value Current Shares Current Value Return Split Adjustment Current price.

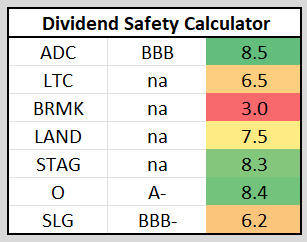

5100 05 5 When you provide those two variables the dividend screener calculates dividend yield for you. One of the big advantages of owning certain real estate investment trusts REITs over common stock is this. ADC with a current annualized 361 dividend.

Of the 7500 plus stocks on the US. Stocks pay dividends quarterly which is nice but monthly. A Real Estate Investment Trust REIT is a company dedicated to owning physical real estate or loaning funds to others for real estate purchases.

The tool makes it easy to identify stocks at possible risk of a dividend cut because their payout ratios exceed 100 or stocks with specific ex-dividend. Realty Incomes most recent monthly dividend payment of 02475 per share was made to shareholders on Monday August. Does the down market have you down.

EPR with a current annualized 619 dividend. In order to maintain this tax status ARMOUR is required to timely distribute substantially all of its ordinary REIT taxable income. Find out just how much your money can grow by plugging values into our Compounding Returns Calculator below.

ARMOUR Residential REIT Inc ARR is offering a dividend yield of 1714 or 120 per share annually utilizing monthly payments with an inconsistent track record of increasing its dividend payments. Below you will find a list of real estate investment trusts REITs that offer dividend yields of 4 or higher that trade on the New York Stock Exchange and the NASDAQ. Agree Realty Corp ticker.

Importantly a real estate investment trust is required to pay vitually all of its taxable income 90 to its shareholders every year.

The Best Monthly Dividend Stocks Investing Com

Dividend Yield Definition And Tips Dividend Com Dividend Com

Dividend Calculator

5 Monthly Dividend Reits To Buy Now Dividendinvestor Com

Dividend Yield Calculator Calculate The Dividend Yield Of Any Stock

2 Stocks That Cut You A Check Each Month The Motley Fool

5 Monthly Dividend Reits To Buy Now Dividendinvestor Com

Best Monthly Dividend Stocks In Canada For 2022

![]()

Dividend Tracker Build Yours In 6 Steps

Best Monthly Dividend Stocks In Canada For 2022

Dividend Yield Definition And Tips Dividend Com Dividend Com

4 Monthly Dividend Stocks Paying Up To 6 3

5 Monthly Dividend Reits To Buy Now Dividendinvestor Com

Excel Dividend Calculator Calculate Your Dividend Income

6 Best Monthly Dividend Stocks To Buy Now Dividendinvestor Com

Monthly Mailbox Money 2 Monthly Paying Stock Buys Seeking Alpha

Ltc Properties Ltc Realty Income Corp O 3 High Yield Reits Paying Monthly Dividends Benzinga